The price of gold has risen more than 17% since the beginning of the year, making it one of the best-performing assets this year. After fluctuating between $1,800 and $2,000 in 2023, the price of gold surged in March and April of 2024, quickly reaching $2,400.

This behavior has been widely discussed. Historic in its scale and speed of movement, it is especially notable because it contravenes the historically observed relationship between gold and other asset classes. The rise in gold occurred at a time when real interest rates were rising, the US dollar was strengthening, and risk assets continued their ascent early in the year.

The link between real interest rates and gold has been broken since early 2022. Historically, the price of gold has been inversely correlated with changes in US real interest rates, and this relationship has worked well at least since 2006. From a fundamental point of view, this is due to the fact that, being a real asset that does not generate yield, holding gold becomes more costly as positive real rates rise.

Similarly, a stronger dollar usually penalizes dollar-denominated commodities (including gold) because it makes them more expensive for non-US investors (most of whom are gold investors). The rise in the dollar index by more than 4% this year has also not been an obstacle for gold’s advance. Finally, gold is often perceived as a safe haven and tends to perform well in times of stress, which has not been the case this year: US equity volatility has returned to its lows (VIX index close to 12) and credit spreads have tightened significantly. So, how can the exceptional performance of gold be explained? And, more importantly, is it sustainable?

The Demand from Central Banks

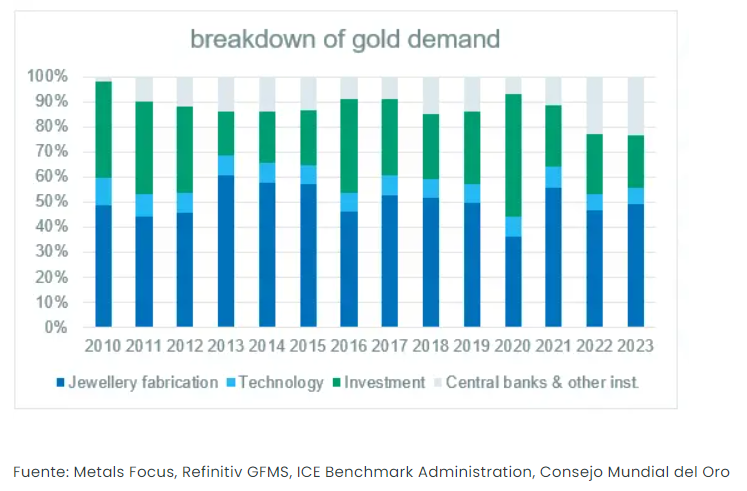

Global demand for gold by central banks has doubled since 2022, from 11% of total gold demand in 2021 to 23% in 2023. This trend continued in the first quarter of this year. Investments in bars and coins, as well as ETFs, which had increased significantly in 2020 (the year of Covid-19), have since decreased significantly. China, being the world’s largest gold producer (10% of mining production), is also the largest importer (20% of demand). The People’s Bank of China (PBOC) increased its gold reserves in 2022-2023, although the total amount remains uncertain, as it is not required to transparently publish all its gold purchases. Similarly, Chinese consumers appear to have channeled part of their savings into gold purchases, although the exact amount is unknown.

Overall, if all central banks in emerging countries reached a minimum of 10% of their reserves in gold, global gold demand would grow by more than 75%. This structural factor seems likely to continue. When surveyed in 2023, 23% of central banks intended to increase their gold reserves in the next 12 months. This impetus to diversify central bank reserves accelerated after Covid-19 and the start of the war in Ukraine. It is probably due to the perception of increased financial risk, linked, on the one hand, to the rise in the US deficit and, on the other, to the sanctions unilaterally decided by the United States against Russia (including the freezing of $300 billion in reserves).

Outlook for Gold

On the supply side, the trend is relatively stable, with annual production hovering around 3,000 tons each year, but demand prospects seem quite good. We anticipate a slightly more favorable macroeconomic context. Real interest rates are likely to remain stable at best, or even decline slightly due to the economic slowdown and the Fed’s initial rate cuts, which should support the price of gold. Additionally, the risk of a return of inflation in the opposite scenario is also favorable for gold, as a real asset, it protects against excessive inflation.

The more structural factors that have driven the increase in central bank purchases, especially in emerging countries, will persist. Geopolitical risks remain present, and the US deficit shows no signs of reducing.

However, as illustrated by the previous chart, central bank demand for gold has historically been quite volatile, as has investment (including ETFs). These two types of demand could accelerate (increasing central bank gold reserves and attracting financial investors to gold), which is our preferred scenario, but visibility on their short-term evolution remains limited. In the medium and long term, the upward trends in gold demand seem more clearly positive.

In a multi-asset portfolio, our simulations show that gold is interesting in terms of diversification, as it has little correlation with the performance of equity or fixed income. Gold also reacts positively to market tensions. A structural portfolio exposure of 3 to 5% to gold, along with other alternative assets, improves the risk/return profile of diversified funds.