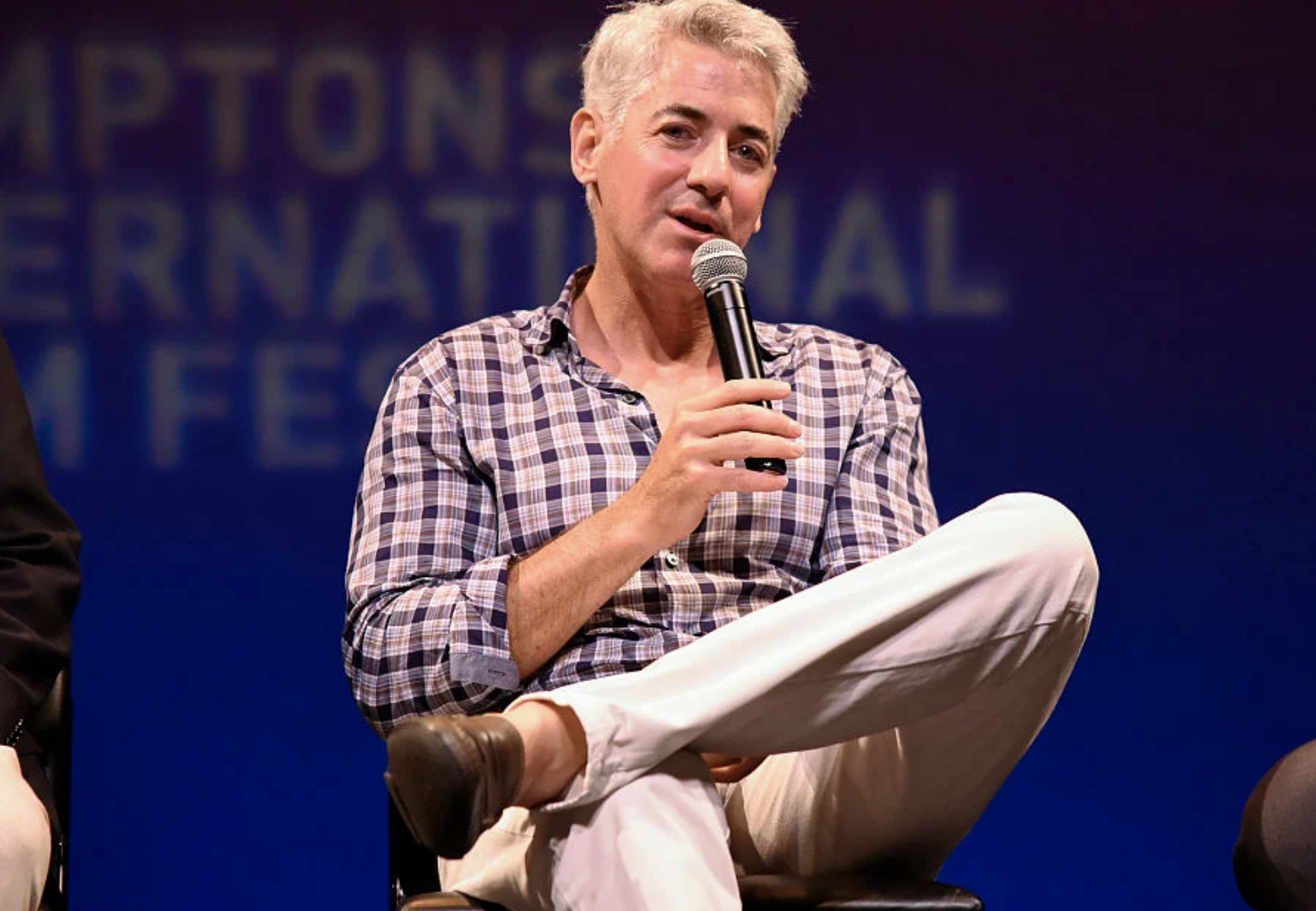

BTG Pactual recently announced the acquisition of a minority stake in the asset management firm led by Bill Ackman, Pershing Square Capital Management.

This strategic move comes at a crucial moment, just before the asset manager’s IPO, which is scheduled for the coming months.

The sale, of a 10% stake in the hedge fund, was carried out for $1.05 billion, to a consortium of institutional investors, including Arch Capital, Consulta Limited, Iconiq Investment, Menora Mivtachim, as well as family offices.

“We are very pleased to invite a group of international and long-term partners as investors in our company, which has been entirely employee-owned at Pershing Square since our founding more than 20 years ago,” said Ackman.

The relationship between Bill Ackman and BTG Pactual leaders André Esteves and Roberto Sallouti already has a history of collaboration in events and stock offerings. In February of this year, Ackman was in Brazil for a bank event. He has also been interviewed live by Esteves on other occasions.

In 2010, BTG was one of the coordinators of the stock offering of a Pershing Square branch on Euronext Amsterdam. This long-standing relationship facilitated the recent acquisition of a minority stake in Pershing Square Capital Management.

By Fórmate a Fondo

By Fórmate a Fondo