The outcome of a portfolio is the result of many different aspects, such as commissions, time horizon, asset classes held, among others, and how they align to increase the value of an investment. One of the main determinants of the performance is the strategy that composes the holdings, which is molded by each portfolio manager’s risk appetite, that depending on the capital, goals, and approach, will range from conservative to aggressive, highlights an analysis by the fund manager FlexFunds.

Tracking a portfolio’s performance is a critical and reassuring component of the investment process, enabling investors and asset managers to gauge the efficacy of their strategies.

Typically, conservative portfolio approaches use a 60/40 strategy, which consists of assigning 60% of the value of the total allocations in equities and the remaining 40% in fixed income; the 60/40 model aims to harness the long-term growth potential of stocks while seeking stability via debt instruments. As reported by the 1st Annual Report of the Asset Securitization Sector, gathering the input of 80+ asset management companies from more than 15 countries, more than half of the professionals interviewed believe that the 60/40 model will remain relevant. To implement this strategy, investors must buy many different securities (distributed in stocks and bonds) to have a diversified holding base. Nowadays, there is a comprehensive inventory of available securities that are integrated by different asset classes within a single instrument. An example of such securities can be a structured note.

What is a structured note? It is a hybrid financial product that combines features of different vehicles in the form of a debt obligation, and its performance is tied to the returns of these underlying.

Using flexible products that repackage different assets in a single security offers a significant advantage by accomplishing the desired weighting distribution without the need for multiple subscriptions, which ends up decreasing the total account value due to fees and commissions. For instance, FlexFunds’ FlexPortfolio allows structuring actively managed notes with no limitations on rebalancing or allocation. Since the securities that compose this product are not fixed or embedded, its composition can be adjusted by the manager depending on the prevailing market conditions and clients’ (investors) best interests, all these while being able to supervise the portfolio performance given that the notes have a NAV that is frequently distributed.

Despite the objective and weighting that each underlying (whether equity or debt) may have in a portfolio, there are a variety of ways in which a note can be designed, meaning that any financial goal can be pursued; it is up to the investor to decide what focus aligns the most with its desired outcome. The most common arrangements are the following:

- Offer upside and growth potential.

- Offer downside protection (hedging).

- Offer an illiquid asset in the form of a marketable vehicle.

- Offer periodic payments/disbursements in the form of coupons.

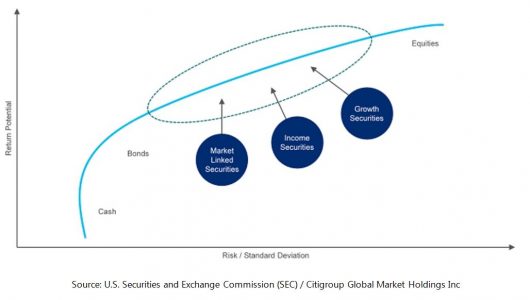

Structured investment targets and how they can make a portfolio more conservative/aggressive:

The preceding graph visually demonstrates how the constitution of a structured security can influence the overall risk-return relationship of an investment allocation, given the nature of its underlying. Equity-like instruments tend to augment portfolio volatility while potentially offering superior returns. Conversely, instruments exhibiting bond-like characteristics can introduce an element of price stability to the allocation.

Every investment process has an expected return for a certain level of risk; considering that we are assessing some of the structured notes’ pros and cons and the impact these may have on a portfolio’s outcome, let’s delve into some of the potential structured notes’ risks.

- Limited Liquidity

They may have limited liquidity, making it challenging for investors to sell their notes before the maturity date due to a lack of a secondary market. There may or may not be buyers for the note, and investors may be forced to sell the securities at a discount on what they are worth.

- Market Risk

While some offer protection against losses, this safety net has its limits. When the underlying experiences high volatility due to market fluctuations, investors can still experience losses. Linking the note to more speculative positions increase the market risk significantly.

- Default

Structured notes can possess a heightened credit exposure compared to alternative options. If the issuer of the note files for bankruptcy, the entire investment could be rendered worthless, regardless of the returns produced by the underlying asset.

Although achieving complete mitigation of all potential structured notes risks, or any other risks associated with individual positions or financial instruments, may be challenging, mitigating at least one may provide an edge in the market.

FlexFunds asset securitization program is carried out utilizing Special Purpose Vehicles (SPV), which makes each issuance bankruptcy remote. This SPV framework ensures that the resources contained within the structure are isolated from the originator’s balance sheet, providing financial protection in the case of bankruptcy or default.

Empower your distribution and reach with innovative yet proven solutions. FlexFunds, a recognized fintech leader in the securitization industry, offers a program of global notes that can help you expand your client base while issuing a flexible investment strategy. Explore which of FlexFunds’ tailored solutions better adapt to your specific needs. Contact us today to schedule a meeting at info@flexfunds.com

Disclaimer:

The purpose of content of the above article, blog, or post is only informational, and it is not intended to provide any sort of investment advice, as an offer of solicitation to buy, sell, or hold, or as recommendation, endorsement of any security, investment, fund and / or company. The content and information provided in the above article, blog, or post does not constitute financial, trading, or investment advice of any type. Neither FlexFunds ETP nor FlexFunds Ltd. is a U.S. registered broker-dealer, or an investment adviser registered with the U.S. Securities and Exchange Commission. Our entities do not raise capital for clients or the Issuers. We do not solicit any specific products, nor offer investment advice or make investment recommendations, nor do we offer tax, legal, financial advice or otherwise. Perform your own due diligence and consult a financial advisor prior to making any investment decision.

Sources:

https://www.sec.gov/Archives/edgar/data/200245/000095010321008888/dp152764_424b2-sibrochure.htm