Investors can’t afford to ignore credit, especially European investors.

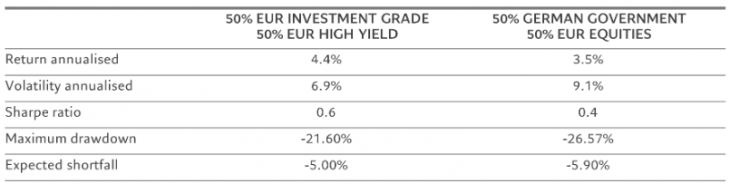

We find that a balanced mix of euro investment grade credit and euro high yield credit would have outperformed an equally balanced allocation split between German government bonds and European equities over the period since a European high yield index was first launched in 2001. What’s more, the credit portfolio’s return and risk profile has been better in both rising and falling interest rate environments.

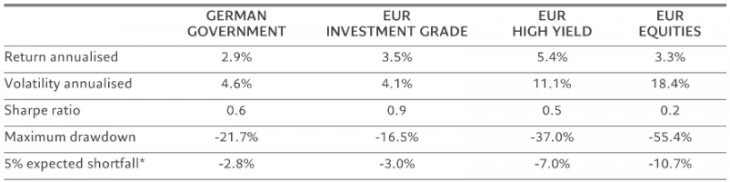

Overall, credit offers better Sharpe ratios – the balance between risk and return – than the more traditional asset classes. So, for instance, euro investment grade credit has offered better returns at lower volatility than German government bonds – the standard “risk-free” instrument. And high yield credit has generated considerably better returns for substantially lower risk than European equities. At the same time, investment grade and high yield credit have had substantially lower maximum drawdowns than German government bonds and European equities respectively (see Fig. 1), while corporate failure is more catastrophic to equity investors than to corporate bond holders.

*Average return of the 5% worst months over the 2001-2023 period. Source: Pictet Asset Management Developed Markets Credit, ICE BofA, Bloomberg. Data covering period 31.01.2001 and 30.11.2023.

And unlike investing in equity where market timing can make a very significant difference in long-run returns, the fact that bonds come with fixed maturities makes market timing less important. Economic growth matters less to holders of corporate debt than it does to owners of equity. And while credit is often seen as a hybrid asset class, showing both bond- and equity-like characteristics, that’s also true of equities, especially in some sectors.

In a nutshell, investors need to re-think the role of credit in their portfolios. Credit should be core.

When investors think of credit, they tend to focus on risk. Investment grade credit is seen in light of corporate uncertainty while government debt represents safety. High yield is often associated with default risk whereas equities represent opportunities such as growth and value. To be sure, investors ought to balance opportunities and risks. The evidence shows that credit offers a better risk-reward profile than corresponding equities and government bonds.

History shows investing in credit delivers steady returns. The asset class’s drawdowns have been temporary, and have always been followed by strong performance rebounds, rewarding the patient investor.

Since 2001 (when data was first available) European investment grade has generated superior returns to German bunds for a similar level of annual volatility, resulting in a significantly better Sharpe ratio.

Over the same period, European high yield credit has generated better returns at lower volatility than European equities, which have failed to compensate investors for the very high level of risk taken, resulting in a poor Sharpe ratio, and have been exposed to extreme negative returns, as shown by the maximum drawdown and expected shortfall.

As a result, replacing German government bonds with European investment grade credit and European equities with European high yield credit delivers 0.77 percentage points more in annual return, with significantly less volatility and less drawdown. At the same time, the credit portfolio posts smaller average losses during the worst market downturns (see Fig. 2).

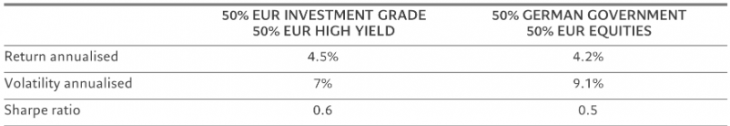

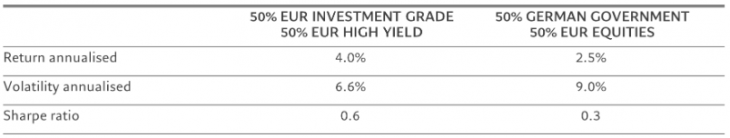

This result remains the same whether central banks are raising interest rates or cutting them (see Figs. 3 and 4). Setting the 10-year German sovereign rate as the reference rate, the properties of the two portfolios have been computed during the years when the interest rate has been increasing (10 years out of 23) and during the years when the interest rate has been decreasing (13 years out of 23). In both environments, the credit portfolio exhibits superior returns with lower volatility, and therefore a better Sharpe ratio, in comparison to the mix of government debt and equities.

Figure 4 – …and when they fall

Blended portfolio performance in declining rate years

Pictet Asset Management Developed Markets Credit, ICE BofA, Bloomberg. Data covering period 31.01.2001 and 30.11.2023.

When faced with interest rate and growth risk, investors also often downplay credit as a hybrid asset class relative to “pure” equities and government bonds. That’s a mistake. In reality, all of these asset classes incorporate opportunities and threats that are related to interest rates and systemic risks. Credit, however, offers better risk-adjusted returns and stronger recover rates after temporary downturns.

Opinion article by Ermira Maricka, Head of Developed Markets Credit at Pictet Asset Management.

Discover how to optimise your portfolio with European credit here.

Disclaimer

This material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

Information, opinions and estimates contained in this document reflect a judgement at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For UK investors, the Pictet and Pictet Total Return umbrellas are domiciled in Luxembourg and are recognised collective investment schemes under section 264 of the Financial Services and Markets Act 2000. Swiss Pictet funds are only registered for distribution in Switzerland under the Swiss Fund Act, they are categorised in the United Kingdom as unregulated collective investment schemes. The Pictet group manages hedge funds, funds of hedge funds and funds of private equity funds which are not registered for public distribution within the European Union and are categorised in the United Kingdom as unregulated collective investment schemes. For Australian investors, Pictet Asset Management Limited (ARBN 121 228 957) is exempt from the requirement to hold an Australian financial services license, under the Corporations Act 2001.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act. Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3. Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd), Pictet Asset Management SA (Pictet AM SA) and Pictet Alternative Advisors (PAA).

In Canada, Pictet AM Inc is registered as an Exempt Market Dealer authorized to conduct marketing activities on behalf of Pictet AM Ltd, Pictet AM SA and PAA.