In the world of investing, fixed income has traditionally been associated with stability and income generation. This role has been uniquely challenged since the spring of 2022, when the Federal Reserve embarked on a series of massive rate hikes – at one point, four 75 basis points hikes in a row – which the markets have not experienced in a generation. Not surprisingly, many fixed income strategies and indices posted the worst total returns in their history, but the silver lining to rate hikes has been the return of higher yields in short-dated instruments such as Treasury bills. Naturally, many investors flocked to the front-end of the curve, taking advantage of these elevated yields, but now is an opportune time to reallocate some of this cash into the fixed income space.

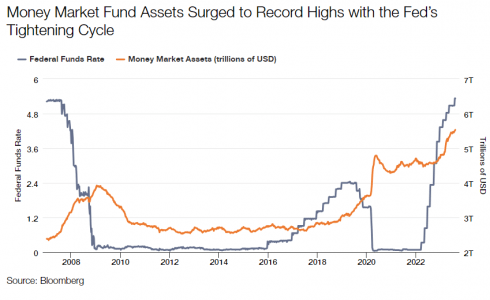

Let’s begin by discussing the current interest rate environment, specifically the implications of the Fed’s hiking cycle. The Fed and other central banks have used their policy rates as tools to bring exceedingly elevated levels of inflation back towards what they deem to be “normal” or within their respective target ranges. While this has caused some anxiety among investors, particularly in risky asset markets, it has also led to attractive yield generation in short-term instruments like Treasury bills, money market funds, and certificates of deposit (CDs). As of July 31, 2023, the 6-month Treasury bill yielded 5.46%, the highest level in 23 years. As yields have risen, the money has followed, with prime and taxable money market funds taking in a combined $744 billion in flows for the 1-year period ending July 31, 2023, per Morningstar. Contrast this to the taxable bond space, which has experienced a net outflow of $85 billion over the same period.

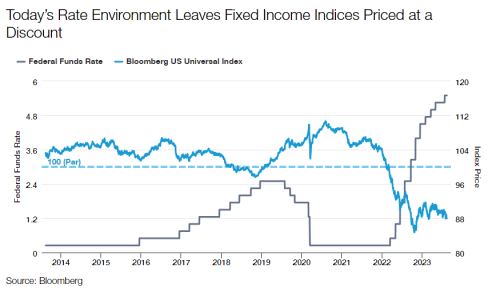

Rising rates also have the effect of increasing the coupons paid on new fixed income securities, which should support forward looking returns. But perhaps more importantly, the rate sell-off has decreased the dollar price of bonds already in existence, many of which are government or investment-grade corporate bonds with low credit risk. As a result, the bond market is priced at a discount even though fixed income securities, with the exception of a default event, mature at “par” or $100. It is this “pull to par” that should drive attractive returns and ultimately better economic outcomes than even the seemingly attractive yields provided by cash instruments today.

The term “pull-to-par” refers to the tendency of fixed income securities to move towards their face value (par value, or $100) as they approach maturity. Bonds priced at a discount will see their prices rise as they get closer to maturity, while bonds trading at a premium (that is, above $100) will see their values fall to par over time. In today’s environment, with the Fed near or at the end of the tightening cycle (as of this writing), fixed income securities with prices below their par value have potential for meaningful price appreciation. That appreciation, in addition to regular coupon payments, leads to larger total returns for investors. We believe this total return likely eclipses the yields that may be earned on short-end instruments.

To illustrate how unique the current fixed income environment is, let’s examine historical price data for various fixed income indices over the last 10 years. In the chart below, we show average price for the Bloomberg U.S. Universal Index. For the vast majority of the 10-year period, average price for the index was either near or above par, with the mean dollar price at about $102. Rising rates have driven the average dollar prices of the index, and active portfolios as well, down to near unprecedented levels, currently below $90. Given the quality of the constituents of the index, it is reasonable for an investor to believe that these bonds will pull back to par as they get closer to maturity, thereby providing investors with an additional boost to performance over and above just clipping coupon payments.

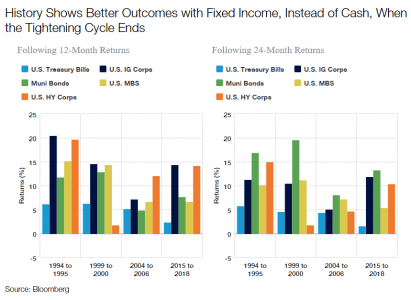

Another lens to look at the relative value of owning fixed income versus cash instruments can be seen in historical data on how both have performed in an environment similar to the present one, that is, with the Fed near or at the end of its hiking cycle. We looked at data for the last four Fed tightening cycles going back to the mid-1990s to see how both cash and fixed income performed as the cycles ended. We used the ICE BofA U.S. Treasury Bill Index as a proxy for short-term instruments and selected four Bloomberg indices representing both above and below investment-grade securities for fixed income. As the table shows, the subsequent one- and two-year returns produced, in most cases, better economic outcomes when owning fixed income as opposed to staying invested in Treasury bills. In the current environment where the Fed is at or near the end of its tightening cycle, and with an elevated chance of economic weakness going into 2024, fixed income has a similar potential to outperform cash instruments this time around.

By combining both the return generators of coupon and the “pull-to-par” effect, investors may outperform Treasury bills, CDs, and money market funds in the months and years ahead. We believe active management remains a valuable tool to capture these excess returns and potentially add alpha over benchmark indices. Many fixed income securities with attractive risk and reward characteristics, such as short-dated, investment-grade rated bonds within the asset-backed securities and residential mortgage space, sit outside of benchmarks and represent some of today’s most compelling opportunities.

The concept of earning coupon plus the pull-to-par represents a valuable opportunity for fixed income investors moving forward. By understanding how this phenomenon impacts fixed income securities’ total return, investors can capitalize on the current opportunity it presents. When combined with effective active management strategies, the pull-to-par effect may serve as a powerful tool to achieve outperformance and enhance overall returns. But timing is of the essence. The economy will eventually weaken, and perhaps tip into recession. Yields today look to be interesting even in a high-quality portfolio. So now is the time to make those moves, not to wait until yields fall.

Opinion article by Rob Costello, client portfolio manager in Thornburg Investment Management.

Important Information

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

This is not a solicitation or offer for any product or service. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein.

Investments carry risks, including possible loss of principal.

Please see our glossary for a definition of terms.

Outside the United States

This is directed to INVESTMENT PROFESSIONALS AND INSTITUTIONAL INVESTORS ONLY and is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to the laws or regulations applicable to their place of citizenship, domicile or residence.

Thornburg is regulated by the U.S. Securities and Exchange Commission under U.S. laws which may differ materially from laws in other jurisdictions. Any entity or person forwarding this to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution.