In the last five years, AFOREs began to diversify their local private equity investments (CKDs) with international investments (CERPIs). Of a total of $ 25.657 billion dollars of market value as of June 30, 61% are local investments and 39% international investments, however, the committed capital is more than double, at $ 53.142 billion dollars, divided between local investments (47%) and international (53%).

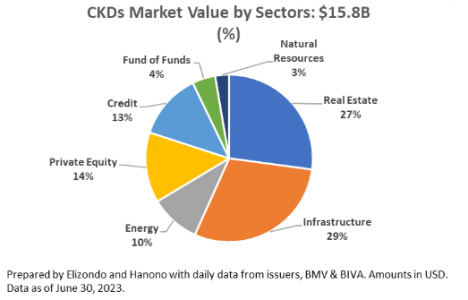

In local investments (CKDs) there is a sectoral diversification that in market value is lead by the infrastructure sector with $ 4.666 billion dollars; followed by the real estate sector with $4.278 billion dollars; the private equity sector with $2.143 billion dollars; credit $2.024; energy $1.527; and Fund of Funds with $704 million dollars and Natural Resources with $424 million dollars.

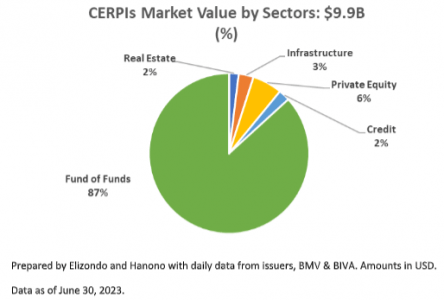

As for the CERPIs (investments in international private equity funds) the market value and number of CERPIs are led by Feeders: 179 of 193 CERPIS are in that category and have a total of $ 8.58 billion dollars of the $ 9.89 billion dollars in the asset class. The 193 CERPIs are concentrated in 30 issues, considering series and subseries.

These options have allowed the institutional investor to diversify, optimize performance, as well as reduce operational, administrative and issuance costs, among others. There are other CERPIs of Private Equity, infrastructure, Real Estate and Credit to name the most relevant. It is important to mention that the Feeder is a passive administrator or administrative service provider.

Between January and June, 52 CERPIs and one CKD have been placed. Of the 52 CERPIs: 49 are Feeders, two of Private Equity and one of Energy. The number of CERPIs has grown exponentially due to the specialization that investments are having in terms of risk and life that allow them to be assigned in one of the 10 SIEFOREs that at least has the 10 AFOREs or in several, so the number should not be surprising. This specialization by SIEFORE was not seen in the CKDs in the 14 years they have been in existence.

The drop in the number of CKDs and emissions does not mean that the institutional investor will stop investing in local projects, but that he will be equally or more demanding than before in new investments, since international investments are giving him elements of comparison.

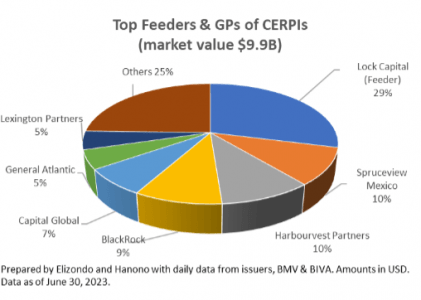

In the 193 CERPIs that exist as of June 30, the following can be identified as issuers: Feeders, GPs and advisors that have CERPI. It is interesting to note that while in Chilean AFPs the concept of advisors in private equity funds was not developed, in Mexico a market was created where the main international firms participate.

Seeing the growth of the Feeders it could be said that the tendency will be to continue to see more GPs and advisors managing CERPIs and most likely that the GPs that have CERPIs also feed the Feeders, a situation that most likely already occurs. Of the 24 administrators of CERPIs, 14 have between 1 and 2 CERPIs; 9 have between 3 and 11 CERPIs and one has 119 of the 193 CERPIs.

Column by Arturo Hanono