Emerging market debt – both sovereign and corporate – should benefit as the dollar’s relentless advance of the past 15 years starts to run out of steam.

Aligning stars

The stars are aligning for emerging market (EM) debt. And according to our analysis, there are good reasons to believe these assets – both sovereign and corporate bonds – are on the cusp of an upswing that could last for years to come.

To begin with, there’s a shift in the direction of the US dollar. The signs are that the currency’s relentless advance of the past decade is starting to run out of steam. US exceptionalism is being called into question: investors’ appetite for risk is steadily returning following the Covid pandemic, the initial shock caused by the Ukraine war and years of disinflation and distortive monetary policy.

And with the dollar playing a smaller role, other factors are likely to take over in driving EM fixed income.

One boost is likely to come from China’s dramatic volte-face on its Covid policy, dropping draconian lockdowns for complete reopening of its economy.

Then there’s EM economies’ deft handling of inflation. EM central banks acted early and decisively to contain inflationary pressures, leaving developing economies well placed to significantly outgrow their developed counterparts.

Together, these factors are bound up in what is arguably the most important source of EM fixed income performance: foreign exchange.

For EM fixed income, currency movements are consequential – not only for bonds issued in local currencies but also for those denominated in US dollars. Currency movements can create feedback effects that have a major bearing on a country’s overall finances. Similarly, they can have a critical role to play in EM corporate balance sheets.

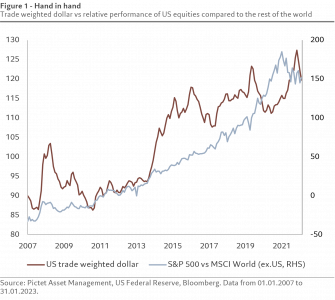

For investors, this can result in substantial compounding effects – appreciating local currencies generate virtuous cycles that feed through to fixed income returns. This is apparent in the relationship between the dollar’s relative value and how global asset markets perform – a weaker dollar tend to be associated with relative strength in non-US assets and a strong dollar with stronger US assets.

Opinion written by Mary-Therese Barton, Head of Emerging Market Fixed Income of Pictet Asset Management, and Alain Nsiona Defise, Head of Emerging Markets – Corporate of Pictet Asset Management.

Discover what the dollar impact will be on emerging market bonds

Authors of the article:

object(WP_Post)#22207 (24) {

["ID"]=>

int(126055)

["post_author"]=>

string(1) "7"

["post_date"]=>

string(19) "2020-12-01 10:09:02"

["post_date_gmt"]=>

string(19) "2020-12-01 10:09:02"

["post_content"]=>

string(736) "Mary-Therese Barton joined Pictet Asset Management in 2004 and is Head of Emerging Market Fixed Income, overseeing the Emerging Market Sovereign, Corporate and Greater China debt strategies.

Prior to joining Pictet she worked at Dun & Bradstreet, where she was an economist responsible for analysing European countries.

Mary-Therese graduated with a BA (Hons) in Philosophy, Politics and Economics from Balliol College, Oxford. She also holds an MSc with distinction in Development Finance from the Centre for Financial Management Studies, SOAS (School of Oriental and African Studies), part of the University of London. Mary-Therese is also a Chartered Financial Analyst (CFA) charterholder."

["post_title"]=>

string(19) "Mary-Therese Barton"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(21) "mary-therese-barton-2"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2023-05-25 19:43:42"

["post_modified_gmt"]=>

string(19) "2023-05-25 17:43:42"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(59) "http://localhost/fundsdevmoo/profile/mary-therese-barton-2/"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Mary-Therese Barton joined Pictet Asset Management in 2004 and is Head of Emerging Market Fixed Income, overseeing the Emerging Market Sovereign, Corporate and Greater China debt strategies.

Prior to joining Pictet she worked at Dun & Bradstreet, where she was an economist responsible for analysing European countries.

Mary-Therese graduated with a BA (Hons) in Philosophy, Politics and Economics from Balliol College, Oxford. She also holds an MSc with distinction in Development Finance from the Centre for Financial Management Studies, SOAS (School of Oriental and African Studies), part of the University of London. Mary-Therese is also a Chartered Financial Analyst (CFA) charterholder.

object(WP_Post)#22205 (24) {

["ID"]=>

int(214835)

["post_author"]=>

string(2) "37"

["post_date"]=>

string(19) "2023-05-25 19:48:21"

["post_date_gmt"]=>

string(19) "2023-05-25 17:48:21"

["post_content"]=>

string(892) "

Alain Nsiona Defise joined Pictet Asset Management in 2012 as Head of Emerging Corporate.

Previously, Alain worked at JPMorgan in London where he was in charge of managing the Emerging Corporate franchise, worth over USD 2 billion. Prior to JPMorgan, he worked for nine years at Fortis Investments, where he started as a senior credit analyst focusing on the high yield market. He later moved to Emerging Markets Fixed Income as a senior portfolio manager building the emerging corporate business.

He holds a Master's in Business Engineering from Solvay Business School, Brussels and a Diploma in Financial Analysis from the European Federation of Financial Analysts Societies (EFFAS).

"

["post_title"]=>

string(37) "Alain Nsiona Defise"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(19) "alain-nsiona-defise"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2023-05-26 02:02:19"

["post_modified_gmt"]=>

string(19) "2023-05-26 00:02:19"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=214835"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Alain Nsiona Defise joined Pictet Asset Management in 2012 as Head of Emerging Corporate.

Previously, Alain worked at JPMorgan in London where he was in charge of managing the Emerging Corporate franchise, worth over USD 2 billion. Prior to JPMorgan, he worked for nine years at Fortis Investments, where he started as a senior credit analyst focusing on the high yield market. He later moved to Emerging Markets Fixed Income as a senior portfolio manager building the emerging corporate business.

He holds a Master’s in Business Engineering from Solvay Business School, Brussels and a Diploma in Financial Analysis from the European Federation of Financial Analysts Societies (EFFAS).