The property market is beginning to react to the Fed’s tightening cycle. It is no surprise that quickly rising interest rates, stubbornly high inflation, and fears of a looming recession are changing the risk-reward calculation for many real estate investors in both public and private markets.

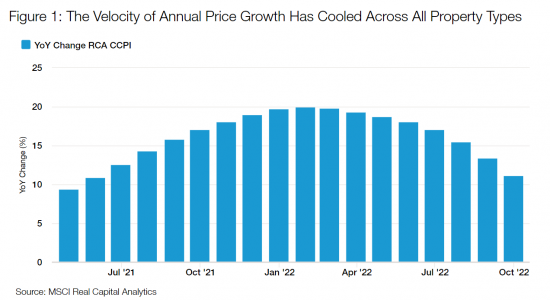

After more than three decades of a low inflation environment, the U.S economy is experiencing broad-based inflation at rates not seen in many years. As a result, the Federal Reserve has raised rates five consecutive times over the past year. For example, as seen in Figure 1, while most real estate indices are still showing double-digit gains over the past year, the overall pace of growth across major U.S commercial properties has already decelerated. Taking a closer look at the table below, the RCA CCPI (Real Capital Analytics commercial real estate prices) National All-Property Index rose 11.1% over the past year, which is a slower pace than that of the record growth seen in January 2022, prior to the Fed’s aggressive rate hikes. We anticipate valuations will continue to contract, potentially creating an opportunity for investors to buy at more attractive prices.

Despite shifts in the market driven by the upward pressure on interest rates and rising inflation, we believe that certain segments of the real estate market feature attractive long-term fundamentals. This is especially true for property types that can benefit from inelastic demand, shorter lease terms, and pricing power that can keep up with inflation. With the right properties, real estate can be an important ally to investors’ portfolios amid evolving macro conditions.

Sizing up Opportunities and Risks

The broad category of real estate includes various sub-asset classes. Commercial real estate, in particular, includes buildings that can generate rental income for investors and are generally spread across four main sectors — multifamily (or apartment buildings), office, industrial, and retail. It also includes more specialized sectors such as hotels, data centers, self-storage, senior housing, student housing, and life-sciences.

Choppier waters ahead will call for a more nuanced approach to distinguishing properties within these sectors that will be better equipped to handle a softer economy and a potentially prolonged inflationary environment. Given the macroeconomic conditions ahead, we favor real estate assets that possess strong long-term fundamentals with attractive valuations, as well as characteristics such as strong pricing power and durable cashflows to better combat inflation.

More specifically, our team prefers properties that have shorter lease terms to ensure that rent escalations can keep up with — or not fall too far behind — near- to mid-term inflation levels. For example, multifamily apartments offer a 12-month term lease structure. Additionally, a portion of tenants turn over each month to allow for frequent opportunities for landlords to reset rents to track inflation. Other worthwhile opportunities to consider include niche areas such as self-storage and hospitality, where rents are charged on a monthly or even nightly basis. However, both asset classes could be affected by a slowing economy. Industrial properties are another area where we see attractive opportunities. Although industrial real estate assets do not generally feature short-term leases, they continue to enjoy strong long-term fundamentals due to secular shifts.

On the flip side, certain segments of the retail sector feature higher levels of risk due to secular trends, although pockets of opportunity do exist. During the pandemic, consumer preferences continued to shift toward the convenience of online shopping versus at brick-and-mortar stores. Although this has since reversed, we anticipate a continued bifurcation of performance within the retail sector, with retail asset type and location driving performance. Moving forward, we see merchants continuing to increase their online presence, while adopting a multichannel strategy to capture sales.

The office sector also presents unique risks. Generally, office buildings tend to have relatively long lease terms (e.g., 5-10 years) which creates inflationary risk for investors compared to multifamily units. In addition, remote and hybrid work have accelerated the need to redesign office spaces with a focus on collaboration and amenities. Thus, we are seeing a significant bifurcation between high-end, newly-developed office buildings — those with state-of-the-art amenities intended to attract workers back in the office — versus older offices that haven’t made such capital improvements. Similar to retail, a “winner take all” pattern may be emerging as currently 15% of office buildings contain roughly 80% of office vacancy nationally, according to Cushman and Wakefield.[1] All things considered, the office sector contains many risks, with limited pockets of value.

We believe having a strong research process that looks across siloes, including public and private markets, will be critical in identifying idiosyncratic risks and uncovering opportunities across all real estate asset classes

Putting it all Together

While macroeconomic conditions will always continue to evolve and present challenges, we believe uncertain times can also create opportunities if managers know where to look for them. As discussed, real estate as an asset class still possesses many attractive characteristics even in a higher rate and inflationary environment, especially in areas where strong rental pricing power exists, lease terms are shorter, and secular trends provide a catalyst for growth. We find that both multifamily and industrial properties hold some of these key advantages compared to other real estate sectors.

Looking ahead, we believe real estate market volatility will persist and market conditions will remain challenging due to the continued transition toward a higher cost of capital environment. This could bring near-term pains, but also long-term opportunities to real estate investors. During this period of heightened complexity, we believe constructing a balanced real estate portfolio that focuses on properties with attractive valuations that can deliver dependable cash flows will be crucial in mitigating the risks associated with the transition toward a lower economic growth and higher rate environment.

Important Information

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

This is not a solicitation or offer for any product or service. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein.

Investments carry risks, including possible loss of principal.

Outside the United States

This is directed to INVESTMENT PROFESSIONALS AND INSTITUTIONAL INVESTORS ONLY and is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to the laws or regulations applicable to their place of citizenship, domicile or residence.

Thornburg is regulated by the U.S. Securities and Exchange Commission under U.S. laws which may differ materially from laws in other jurisdictions. Any entity or person forwarding this to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution.

Please see our glossary for a definition of terms.