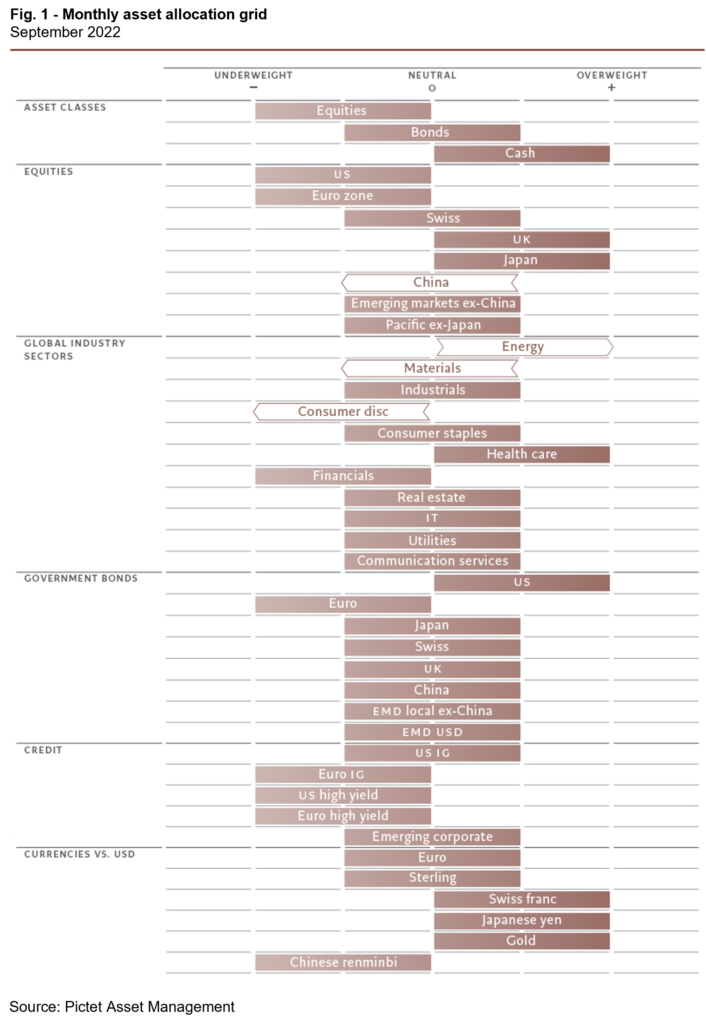

The surge in stock markets that accompanied the summer heatwave is, we believe, over. From here on in, conditions are likely to be much less friendly. As a result, we maintain our underweight stance on equities and our neutral position on bonds, balanced by an overweight in cash.

The summer rally came as falling oil prices boosted hopes the US Federal Reserve could engineer a soft landing for the US economy. Further lifting investor sentiment were data testifying to the US’s economic resilience.

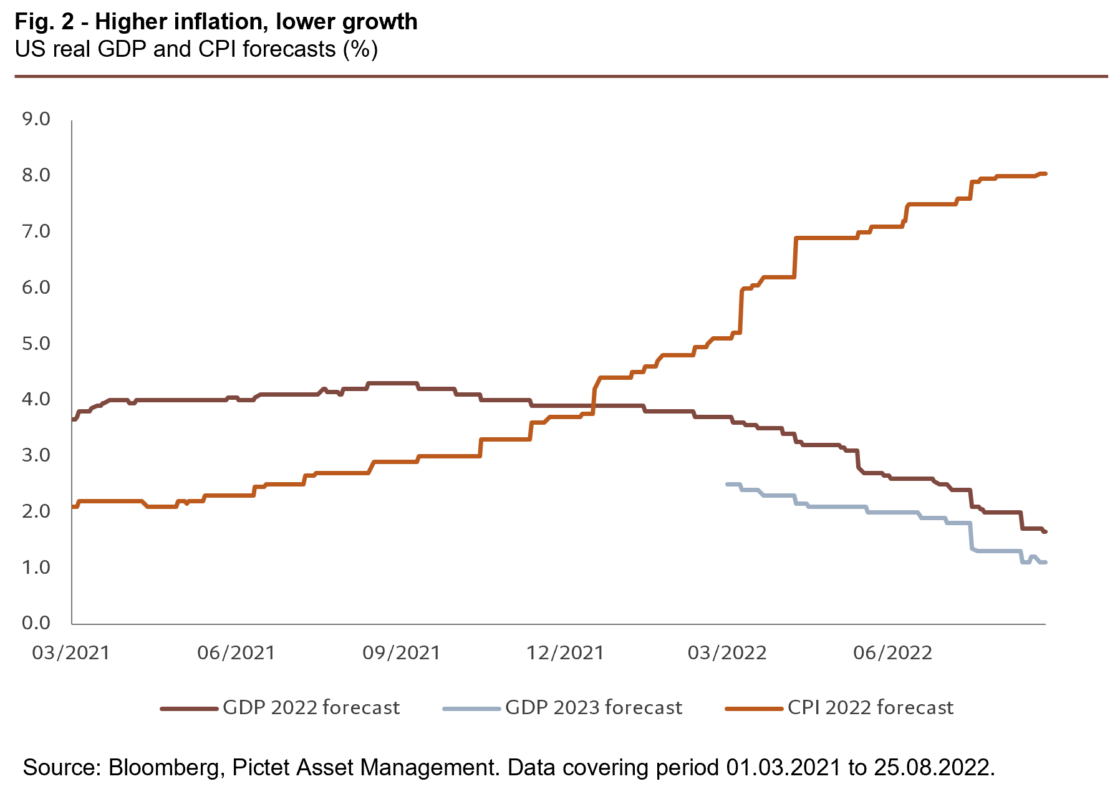

Yet there are reasons to believe the stock market recovery has run its course. Oil prices are rising again. And even if inflation has peaked, it is looking sticky. Business and consumer surveys, meanwhile, are turning gloomy even though central banks are likely to ignore these until they feed through to hard economic data. At the same time, valuation and sentiment indicators no longer offer compelling cases to hold riskier assets (see Fig. 2).

To turn more positive on riskier assets, we’d need to see several developments unfold at more or less the same time.

First, a steeper yield curve. That would suggest strong economic growth down the line; it is also a prerequisite for bull markets. Second, a bottoming of downward revisions to corporate earnings forecasts and to leading economic indicators. Third, technical indicators giving unequivocal ‘oversold’ signals for equities, and cyclical stocks in particular. And finally – for bonds – that the currency monetary tightening cycle is sufficient to get inflation back to central banks’ targets.

Our business cycle indicators point to more inflation surprises and a sustained loss of momentum in economic growth indicators. We have again cut our global GDP forecast for the current year, to 2.5 per cent from 2.9 per cent, largely as a consequence of weakening US data.

We now expect the US economy to grow by just 1.6 per cent this year, from 3 per cent previously. Although leading indicators have been weakening across most regions and sectors, we anticipate both the euro zone and the US will narrowly avoid recession over the coming quarters. Indeed, US survey evidence and hard data increasingly look at odds with one another, with retail sales remaining resilient, unemployment at 50-year lows and residential investment as a percentage of GDP hitting new post-global financial crisis highs.

The euro zone economy outperformed during the first half of the year thanks to pent-up demand following the removal of Covid restrictions, but the latest numbers are less encouraging. The recent surge in European gas and electricity prices is a particular worry. The UK, meanwhile, is clearly sliding into a recession while inflation continues to rip higher, posing an intractable dilemma for the Bank of England. On the other hand, Japan remains a bright spot as do emerging economies, particularly in Latin America.

Our liquidity scores remain negative, with conditions particularly tight in both the US and the UK. Developed market central banks are making policy more restrictive by both raising interest rates and through quantitative tightening (QT) measures that contract their balance sheets – our central bank liquidity gauges show their worst readings since at least 2007. We expect global QT of some USD1.5 trillion this year, equivalent to a 1 percentage point increase in interest rates, which would unwind half of Covid-era monetary stimulus. At the same time, the pace of private credit creation is starting to slow.

Our valuation scores show that following their rally, equities are again looking expensive, while bonds are cheap to fairly valued. For global stocks, year-ahead price-to-earnings ratios have risen by a lofty 15 per cent since mid-June, reducing their appeal. Another negative comes in the shape of corporate earnings, whose growth we believe is running out of steam; we forecast a below-consensus 2 per cent growth in profits for 2022, with risks on the downside if economic growth weakens further. Our valuation models favour emerging markets, materials, communications services, UK bonds, the Japanese yen and the euro and finds as particularly expensive commodities, US equities, utilities, euro zone index-lined bonds, Chinese bonds and the dollar.

Our technical indicators show that trend and sentiment signals for riskier assets have largely normalised, having been negative during the fist half of the year. Despite the summer rally, sentiment indicators are neutral with the exception of utilities and euro zone high yield bonds, which look overbought. Speculative positioning in S&P 500 stocks is close to a record short. But while surveys show continued bearishness, that’s declining, and flows into equity funds have turned positive again.

Asset allocation

We maintain our underweight in equities amid concerns about global growth and our neutral position on bonds as inflation looks to be stickier than expected.

We reduce risk in our equities portfolio by downgrading Chinese stocks to neutral and the consumer discretionary sector to underweight.

We keep a defensive stance by maintaining our overweight in Treasuries and safe-haven currencies. We are underweight European sovereign and corporate bonds and the Chinese renminbi.

Opinion written by Luca Paolini, Pictet Asset Management’s Chief Strategist

Discover Pictet Asset Management’s macro and asset allocation views.

Information, opinions, and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

Important notes

This material is for distribution to professional investors only. However, it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or sollicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management (USA) Corp (“Pictet AM USA Corp”) is responsible for effecting solicitation in the United States to promote the portfolio management services of Pictet Asset Management Limited (“Pictet AM Ltd”), Pictet Asset Management (Singapore) Pte Ltd (“PAM S”) and Pictet Asset Management SA (“Pictet AM SA”). Pictet AM (USA) Corp is registered as an SEC Investment Adviser and its activities are conducted in full compliance with SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref.17CFR275.206(4)-3.

Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in Canada to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd) and Pictet Asset Management SA (Pictet AM SA).

In Canada Pictet AM Inc is registered as Portfolio Manager authorized to conduct marketing activities on behalf of Pictet AM Ltd and Pictet AM SA.