Switzerland, one of the world’s largest offshore financial centers, agreed on Tuesday to exchange tax information with other countries automatically, representing a major breakthrough in the international crackdown on tax evasion. Switzerland joins the growing number of nations that have agreed to share tax information, helping to lift the veil of tax secrecy in almost everyone.

The agreement, which was signed on Tuesday at the OECD headquarters in Paris by a total of 47 countries, provides that the tax information will be shared automatically on an annual basis between governments, including taxpayers’ bank balances, dividends, income from interest, and proceeds from sales used to calculate tax on capital gains, Reuters reported.

The signatories are: Argentina, Australia, Austria, Belgium, Brazil, Canada, China, Chile, Colombia, Costa Rica, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Saudi Arabia, Singapore, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States and the European Union.

Pascal Saint-Amans, Taxation Director of the Organization for Economic Cooperation and Development (OECD), told reporters at a meeting of the group of international experts in Paris that the agreement “clearly puts an end to bank secrecy abuse for tax purposes. This means that governments can actually determine the tax payable by people who thought they could hide in other jurisdictions.”

While most of the signatories were already committed to sharing tax information automatically, the fact that Switzerland signed on Tuesday is a big step in the fight against tax evasion, a struggle which has been intensified by governments since the global financial crisis began and following a series of tax evasion scandals.

As explained by Reuters, financial companies must also identify the ultimate beneficiaries of shell companies, trusts and similar legal entities which can currently be used to evade taxes.

Swiss Banking Reaction

The Swiss Bankers Association reacted quickly and issued a statement stressing that the measure had already been planned for a year, so it does not come as a surprise to the Swiss banks. “Banks in Switzerland are willing to adopt the automatic exchange of information, along with other financial institutions, provided that the information exchanged applies exclusively for tax purposes.”

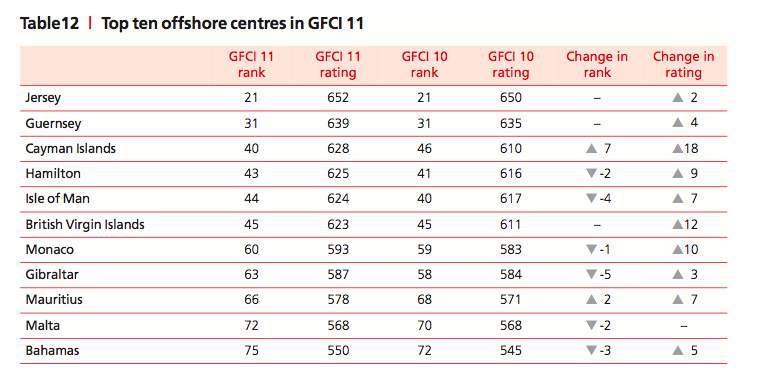

Switzerland joins the group signing the agreement, which includes other members of the OECD, the G-20 countries and other leading offshore financial centers like the Cayman Islands and Jersey. The overall standard has been developed by the OECD and endorsed by the G20 group, says the Financial Times.

Some offshore account holders have transferred their money to a handful of offshore centers such as Panama and Dubai, which have resisted this transparency initiative. Asian centers like Hong Kong and Singapore, which have clients predominantly from Asia Pacific and Middle East, have been less affected by far by the demands for greater transparency, although Singapore has already signaled its willingness to assist other governments to clamp down on tax evasion.

This last statement does not provide a deadline for the exchange of information. However, in March almost all countries pledged to adopt the exchange of information soon, and the deadline has been set for September 2017 to inform governments of origin of investors’ taxation data, which will begin to be collected from 31st December 2015.

Should you wish to see the Declaration on Tax Information Exchange you can do so on the attachment above.

By Fórmate a Fondo

By Fórmate a Fondo