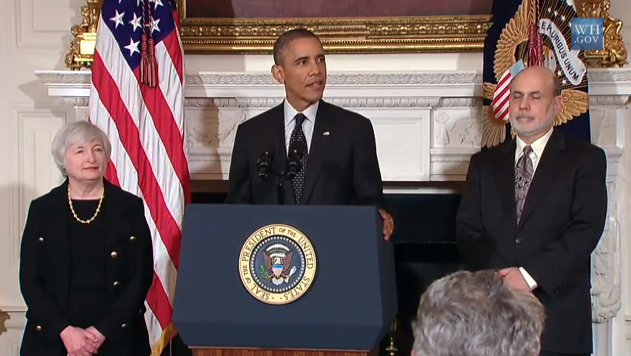

The first press conference of the new Fed Chairwoman Yellen surprised markets, which started to price more future rate hikes. US 2-year bond yields spiked; the 10-year yield rose initially but fully retraced afterwards. Credit spreads hardly moved while surprisingly, emerging market (EM) debt and EM currencies were very resilient and even strengthened.

ING Investment Management still expect the first rate hike of the Fed to take place in the fourth quarter of 2015, but the possibility of an earlier hike has increased.

EM currencies surprisingly resilient since Fed meeting

No significant impact on credit spreads

The impact of Yellen’s statements was primarily visible in the Treasury market, while spread products were hardly impacted. US High Yield spreads rose on Wednesday and Thursday, but found their way back down again afterwards. On Friday spreads were at a lower level than the day before the FOMC meeting. Interestingly, spreads of emerging market debt (EMD) in hard currency did not rise at all, and even moved slightly lower.

One should expect downward pressure on EM

Besides the impact on EMD Hard Currency spreads, the latest developments in emerging market currencies are also striking. Since May last year, the two main worries for EM investors have been the prospect of less easy monetary policy by the Fed and the economic slowdown in China. The fears of Fed tapering were dominant in the May-September period last year. Early this year, worries about China took centre stage after the January HSBC flash PMI index came in weaker than expected at 49.5.

With this is mind, one should have expected that the pressure on EM currencies would increase again after the FOMC meeting. Next to that, Chinese data continued to disappoint, with the HSBC flash PMI again coming in weaker than expected, at 48.1 in March. Finally the ongoing uncertainty about the situation in Ukraine still plays a role. All in all, a depreciation of EM currencies seemed likely in this environment. The opposite happened.

You can read the full report on the attached document.

By Fórmate a Fondo

By Fórmate a Fondo