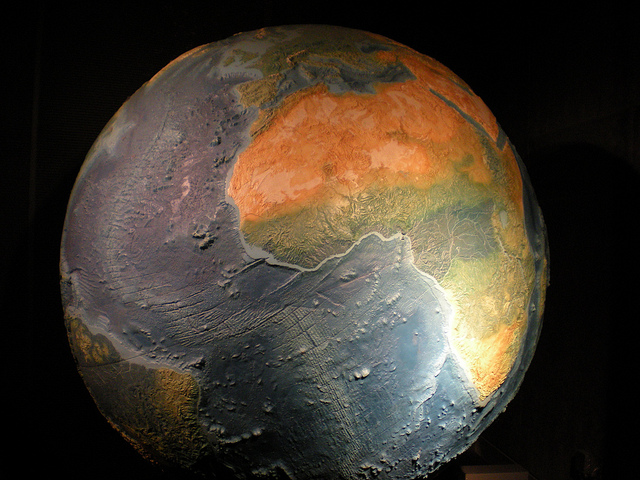

The Latin American pension fund market continues to grow amongst economic and financial challenges. In this environment, local players work to open up to international managers, insofar as the pursuit of profitability and risk diversification intensifies. Therefore, the cross-border distribution towards the pension fund industry in this region represents the largest opportunity for global asset managers and ETF providers, says a recent report by Cerulli.

According to Cerulli, in 2012 both have reached the milestone of 100 billion dollars in exposure by Latin American investors, including the Chilean and Peruvian AFPs, the Afores in Mexico and the closed pension funds in Brazil; 75% of that figure (82 billion) was channeled through cross border funds and ETF, and the rest in venture capital investment, structured products, bonds and stocks. The number of Latin investors in cross-border funds and ETF is more than triple that of 2008, when only 25 billion dollars were earmarked for those investments.

And that amount could continue to grow parallel to the expansion of the size of these private pension systems and the inability of local markets to absorb such capital, a trend which is also supported by the regulatory changes that affect risk diversification. “The assets of mandatory pension funds in Mexico and Chile double every five or six years and these will need to channel increasing percentages of their assets outside their borders.” Cerulli expects local pension managers to derive a large part of those assets to external managers rather than investing in their local markets, as was usual in the past.

A different beat

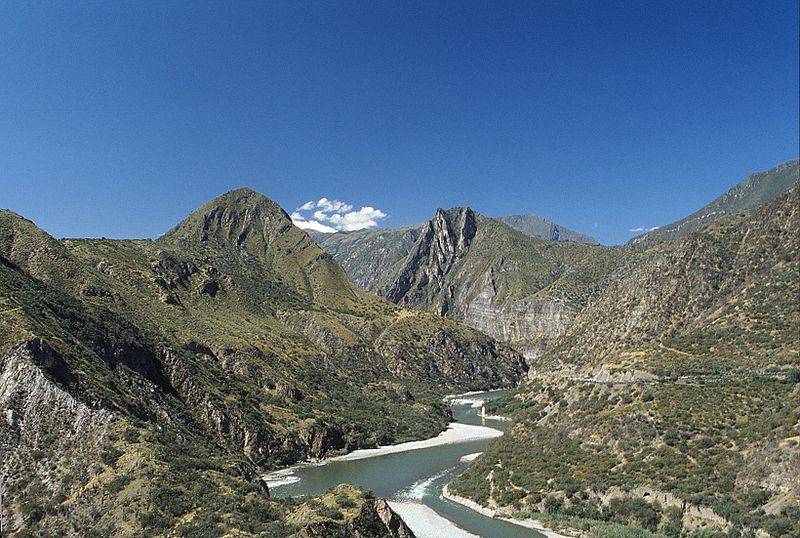

The study shows that pension markets in Latin America have shown similar patterns regarding their openness to global markets, the only difference is that each country is at a different stage of development: while Chile is the most open, followed by Peru (where the AFP have recently expanded their international investment limit to 40%), Mexico and Colombia, Brazil is the market with less international investment, despite being the largest and despite its intentions which also seem to point in that direction, as was commented by José Carlos H. Doherty, CEO of the Brazilian Association of Financial and Capital Markets (ANBIMA), in a recent interview with Funds Society.

According to expectations, the recent regulatory changes in Chile (after the Superintendence and the Finance Ministry allowed the lower risk pension funds, those identified by the letter E, to invest in international instruments as an escape valve for local debt) offer great opportunity and will limit the volatility generated in the input and output flows towards products of foreign managers (because, depending on the risk assumed in each fund, which ranges from the letter A, with higher risk, to E, with less risk, the limits of international investment are descending).

Hopes in Mexico, Brazil and Colombia

But there really are countries which have great potential for foreign managers, and according to Cerulli, Mexico is among them, since Chilean AFPs are very close to their maximum allowed in international investment. It’s the same with the Afores in Mexico, but the limits of international investment are still very low (20%) and their mandatory pension system expands rapidly. “With the new administration, it is likely that the legal limit is increased to at least 40% and potentially to 50% of total assets, with sub-limits for each specific fund within the system” Cerulli predicts. But there will be opportunity for all: The report says that, due to regulatory and tax disincentives, this market will remain a major opportunity for managed accounts or ETF, while active funds will remain “off the menu” for the Afore.

In Brazil, the pension fund industry can position 10% in international assets, although there are other restrictions on the positions in a single fund. But Cerulli believes this could change, and that the industry will open up to international capital markets in the medium term. He believes that in Colombia, after years of investment in local markets, pension managers are “committed” to make allocations globally, driven by a government that wants to curb the peso’s appreciation. “In 2012 the international positions were 15% and a sharp rise is not expected because there are no regulations which encourage it, but we believe that the government’s blessing to invest outside national borders is always welcome.”

By Fórmate a Fondo

By Fórmate a Fondo

By Alicia Miguel Serrano

By Alicia Miguel Serrano