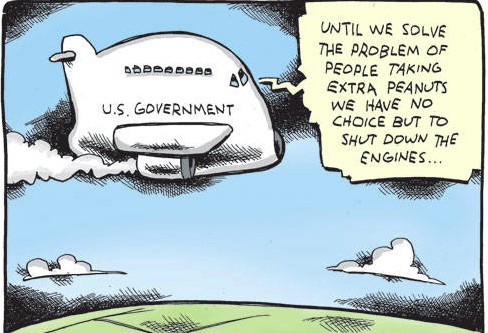

The eurozone isn’t the world’s problem child for once after US political wrangling caused a partial shutdown of government in the world’s most powerful nation.

Debt ceiling debacle

Democrat President Barack Obama is at loggerheads with the Republican controlled US House of Representatives, which has linked his request to raise the $16.7 trillion debt ceiling to avoid a default to partisan policies.

It means that for once, the eurozone isn’t the biggest issue facing investors, following an upbeat month that showed economic growth improving and large-scale political problems avoided, says Léon Cornelissen, Robeco’s chief economist.

“We think the US government shutdown will be short lived, as it is highly unpopular and could turn out to be very damaging to the Republican Party,” he says. Equity market volatility has been rising since the crisis began at the start of the month.

“Furthermore, in our opinion, no US president would allow the US to default. The most likely outcome is that the Republican front will break before a default is imminent.

“Otherwise Obama would resort to emergency measures as a last resort. We think the current political theatrics will temper economic growth only temporarily. The US economy is showing underlying strength, as demonstrated by the healthy developments of the ISM manufacturing and non-manufacturing indices.”

“Current political theatrics will temper economic growth only temporarily”

Tapering? What tapering?

Investors were surprised when after months of fanfare about the impending tapering of quantitative easing, the US Federal Reserve decided not to start scaling down its $85 billion-a-month program in September after all.

“But given the underlying strength of the US economy, the start of tapering is inevitable in the coming months,” says Cornelissen. “As markets are now completely left in the dark about future Fed policy, making a call on the precise moment that tapering will begin is very difficult, and it will be highly dependent on recent economic data.”

Eurozone confidence is improving

The US’s problems lie in contrast for once to improving confidence in Europe. European PMI surveys for September confirmed that the eurozone recovery is gaining traction, and political problems have abated.

Economic recovery is being led as usual by Germany, but France has also returned to growth, and data for Italy and Spain were also upbeat. Italy avoided yet another change of government, while Angela Merkel’s re-election as German Chancellor confirmed a strengthening European leadership, Cornelissen says.

Headline inflation in the EU fell in September to 1.1% on a yearly basis, and core inflation dropped to 1.0%. This gives the European Central Bank some room for additional stimulus, although it won’t be in a hurry to act, due to the current economic recovery. However, we should not get carried away, as the eurozone remains vulnerable to political risk, Cornelissen says.

World economy also improving

More generally, the world economy is recovering steadily. “Inflationary developments have in general been benign, so there is no need for central banks to reign in their ultra-loose monetary policy,” he says.

And the Japanese economy is currently clearly improving, as illustrated by the reading for the Tankan survey for large manufacturers which rose in the third quarter from 4 to 12. ‘Abenomics’ is on track, and the ‘third pillar’ of stimulus is eagerly awaited, though the upcoming sales tax hike does carry risks for growth, he says.

Asset class top picks

Regarding asset classes, Robeco’s Financial Markets Research team remains neutral on equities. “Delayed withdrawal of excess liquidity by the Fed is sustaining expansion of equity market multiples, but risks remain,” Cornelissen says.

Risky assets such as equities performed well in September, thanks to the Fed’s decision not to start tapering. However, higher rates and the end of easy money are still on the horizon, and Robeco prefers to wait for a correction in equity markets before raising the weight of equities in portfolios.

High-yield bonds are still Robeco’s favorite asset class. Our strategists expect default rates to remain low in the near term and in their opinion absolute return is still very decent. While they are positive on corporate bonds, the team is negative on government bonds because the current environment of low or negative real interest rates makes sovereign debt unattractive relative to higher-yielding fixed income classes.

China strong but emerging markets mixed

Real estate remains out of Robeco’s favor due to its sensitivity to potentially higher interest rates once tapering does start. And the outlook for emerging markets is mixed, Cornelissen says. “The Chinese economy is showing acceleration and China is heading for a strong third quarter, but the big question is whether this accelerated growth is sustainable,” he says.

“We remain neutral on commodities. Although we think that escalation risk from ongoing tensions in the Middle East has eased considerably, with no military intervention in Syria and conciliatory noises coming from Iran, we think energy prices will move sideways.