Data indicate that the Chinese economy may have found some temporary support. According to the MarketExpress report published by ING Investment Management, Further support for commodities and other risky assets could come from abating tapering fears and a stabilization in bond yields.

For equities, commodities and other risky assets it will probably not be a smooth ride in the weeks ahead. We mention risks as geopolitics (Middle East), tapering and the German elections (September 22). Furthermore, Japan has to decide upon the increase of the sales tax and in the US debt-ceiling discussions will soon emerge. In the near term, these factors could weight on risky asset prices.

Nevertheless, we remain inclined to look for more rather than for less cyclical tilting. We point to the ongoing favourable economic data, globally. Recently, the improvement in Chinese data also provides support. The data add more juice to the overweight in cyclical sectors. Furthermore, the situation changed for the better for commodities.

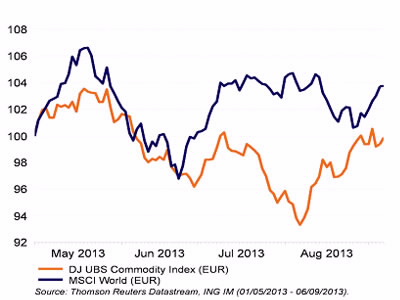

Commodities bottomed in August after better Chinese data

Rising yields are biggest headwind for commodities

The biggest headwind for commodities currently seems to be the rise in bond yields in the developed economies. Not only capital flows to emerging markets are reduced for that matter, they are also putting (commodity) demand and emerging market currencies under downward pressure. Depreciating currencies in the emerging world themselves also prevent supply discipline at commodity producers in emerging markets. After all, depreciating currencies lower their production costs and increase their revenues in (appreciating) US dollars.

Welcome support for commodities and risky assets

As already said, the recent improvement in Chinese data is very welcome in the September month which is traditionally the weakest month in the year for equities, commodities and other risky assets. Currently, the better data in China were even more welcome against the background of some additional risks (Middle East, tapering) that the global economy and global markets have to digest. A most welcome support for the commodity asset class would arise from abating tapering fears and from some stabilisation in government bond yields.

To view the complete story, click the attached document.