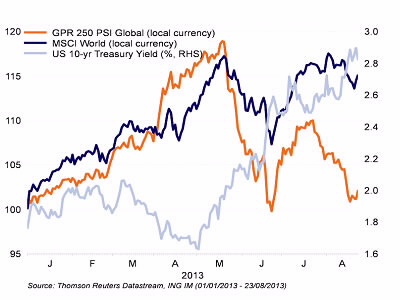

Investor risk appetite is getting depressed by the renewed rise in treasury yields in developed markets. In contrast to the correction in May/June, credit and commodity markets are holding up well. Real estate equities are having a hard time, while emerging market assets continue to struggle.

In this enviroment, ING Invesment Management scaled back their position in global real estate to neutral. Rising (real) interest rates in developed markets weigh relatively heavily on real estate equities as funding costs increase for this more leveraged asset class.

Real estate is very sensitive to the rise in treasury yields

Correction in equities, real estate and emerging markets

The renewed rise in government bond yields of developed markets has clearly started to weigh on investor risk appetite. With 10-year treasury yields in the US, UK and Germany increasing by 20 to 30 basis points in the past two weeks, especially equity and real estate markets have started to correct. The most probable reasons behind this are fears of an erosion of growth prospects and higher funding costs.

Also, emerging market (EM) assets have seen another round of downward pressure as higher US treasury yields further increased the risk of intensifying capital outflows. Especially emerging market currencies suffered last week, but also EM debt and equity markets underperformed their global peers.

Notable differences compared to last correction

At first sight, these dynamics look similar to the market evolution that occurred in late May and June. Some interesting differences are also visible below the surface, however. Most notable is the substantially higher resilience that is seen in credit and commodity markets. Both have hardly lost performance over the past two weeks, while they fell significantly during the May-June correction. Also, cyclical equity sectors are holding up quite well, while a notoriously “high beta” region like Europe is outperforming in equity space.

To view the complete story, click the attacehd document.