Japanese stocks have taken a severe beating since the last week of May. ING Investment Management feels that the correction is not justified taking into account Japan’s fundamentals and they believe that the Japanese equity market can resume its outperformance. They asset manager stick to their overweight position in Japanese equities.

Investor confidence in the ‘reflation trade’ has diminished in the past weeks, after Kuroda failed to explain if the BoJ would like to see lower or higher yields as a sign of success of its policy actions. Japanese bond yields rose substantially while the yen reversed its decline and a sharp sell-off emerged in the Japanese stock market. We believe however that the fundamental story has not changed and expect the Japanese market to resume its outperformance.

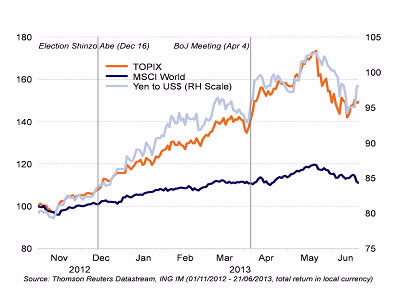

Japanese stocks and yen move hand in hand

Japan stands out in economic and earnings momentum

For some time now, we observe increased divergence in global market performance whereby local factors are dominant. Economic momentum, earnings momentum and shifts in policy are the main determinants of these relative regional performances. Let’s take a look at each of these three drivers.

First, the economic momentum as measured by the economic surprise indices is on a rising trend. Japan is one of the few countries where the index is actually in positive territory. Not only the surprises are strong, also the data themselves improve.

Second, earnings momentum is highly positive with upgrades outnumbering downgrades in a 2 to 1 ratio. Momentum is one element but also the actual growth estimates are high. We forecast 40% earnings growth this year followed by an additional 18% in 2014.

Reform momentum to pick up after July elections

The third element is policy. True, the BoJ’s communication policy is not optimal and has contributed to the market volatility. Especially as the positive outcome from its real time policy experiment is not guaranteed. Its binary character implies that minor changes in expectations can lead to a disproportionate increase in market volatility. On the other hand, the BoJ will possibly take additional action as the market environment has diverged from its initial expectations.

Likewise, Abe has every interest in the support of financial markets in the run-up to the Upper House elections on July 21. The structural reforms he has announced are a necessary step to make the recovery sustainable. Details are scarce however and we will hear more about it in the months to come, mostly so after the elections.

To view the complete story, click the document attached.