One of the victims of the market correction are emerging market assets. They suffer from outflows due to less favourable carry trade opportunities and weak Chinese data. More structural issues rise to the surface too, however. ING Investment Management have underweight positions in both emerging market equities and debt.

Indiscriminate selling has been seen in those areas of financial markets that have seen the largest capital inflows in recent years, with corporate credit, emerging market debt and “stable growth” equity sectors as obvious victims. Parts of these market segments had clearly come over-extended on the back of relentless investor inflows during the last two years and could have been expected to correct at some point.

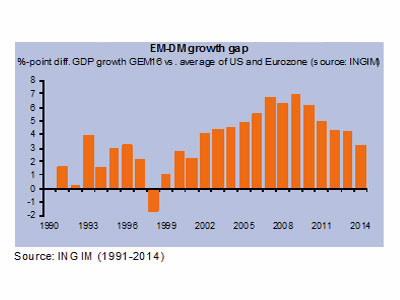

Growth differential between EM and DM is narrowing

Pressure on emerging markets is mounting

In the current environment, emerging market assets are vulnerable as investment flows into the region are likely to weaken due to market concerns of early tapering of quantitative easing (QE) by the Fed and a narrowing interest rate differential (‘carry’). Moreover, we also see more fundamental weakness threatening emerging market assets.

In the developed world, we have seen more structural change since the outbreak of the global financial crisis, which creates room for positive growth surprises compared to the emerging world. The combination of better economic data in the US and disappointing growth in China is clearly negative for emerging markets. Growth in EM in the past years has been driven primarily by Chinese demand and carry trade related flows. Both sources of growth are coming under more pressure now; the former because of increasing evidence of the structural slowdown in China and the latter because of increasing market nervousness about the Fed’s QE policy.

To view the complete story, click the document attached.