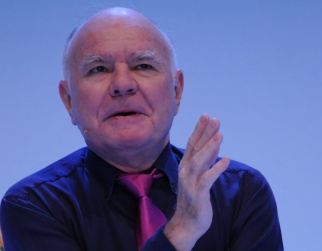

Another crisis is inevitable, argued Marc Faber at the Robeco World Investment Forum. So how should investors position themselves? And how can you spot when the asset-price bubble will burst?

Q: Do you believe that current asset prices are an accurate reflection of risks?

A: No, certainly not. I believe that asset prices today have been distorted by artificially low interest rates. If interest rates are at zero, it is difficult to value anything. There is no real value.

Q: Would you say that the monetary easing in the US has been the core of the financial problems we are facing at the moment?

A: Yes, monetary easing and the expansionary monetary policies over the last 30 years, which led to excessive credit growth, have been a major factor in causing the financial crisis of 2007/2008 and the continuous malaise we have up to today. But I would also say that other interventions by governments, their fiscal measures, have also been very disruptive for the economy.

Q: You have talked about how these expansionary policies are like taking a mortgage out on future generations. Can they ever repay the debts that have been built up?

A: Future generations will never be able to pay their debts and the entitlements for retirees. But I also would like to introduce another concept: it depends on what you use the debt for. If you borrow money and build a factory that produces something that results in cash flow and profits, and allows the interest on the borrowings to be repaid, and to have surplus cash for further investments, that it is one story. But if you just borrow money to go on holiday, that is another story.

Q: What is the way out?

A: The way out is to do something different from what we have done in the past. Under the influence of today’s central bankers and neo-Keynesian politicians, there is more stimulation, more government intervention and more money printing. They do precisely the things that led to the crisis. But that is not the right medicine. The best thing would be for all the boards of central banks to resign. We need new people running central banks that have monetary responsibility.

Q: What should investors do?

A: We have to live with the fact that money is being printed. This money will flow into different sectors and different markets around the world. This will not lead to less volatility, it will lead to more. So you will have bubbles in NASDAQ, real estate, commodities, emerging markets and government bonds. Now we have a gigantic bubble in sovereign debt. Investors need to diversify and avoid buying asset markets that have become overly popular.

Q: We are still in the monetary easing phase. What is going to happen?

A: We will have a huge systemic crisis. The last time the financial sector went bust, it was bailed out by governments. The next phase is governments themselves go bust. Before they do that, they print money like there is no tomorrow. We do not know when the crisis will happen. It could happen tomorrow, but it could also happen in three, five or ten years’ time. Like when your computer crashes, there will be a re-booting of the global economy. But before that, most likely we will have high inflation rates, maybe we will have a deflationary collapse and we will have wars. We are all doomed.

Q: Are there indicators that can predict when the bubble will burst?

A: In my opinion, there is already one indicator that is already flashing a very heavy warning signal. Asset prices are going up, but the standards of living of the typical household in Europe and the US—I am not talking about the people who work for Goldman Sachs—are going down. The industrial economy is doing badly. The linkage between money printing and the industrial economy has already broken down. The rich are buying second homes in the Hamptons, luxury apartments in New York City and Mayfair, paintings, gold—all completely unproductive assets. They are not going to build a new factory. They are not going to start a new business. Nothing is being created economically.

Q: Why aren’t they investing?

A: They are not investing because of excessive regulation. Take, for example, ObamaCare. It is an administrative nightmare. People are reducing their business activity. Firms are not investing in the US, but instead they acquire other companies and downsize. They lay off people.

Q: Do you predict a revolution if income inequality increases further?

A: When the masses of the poor become more powerful than the few, the rich have to pay. Usually history has solved this problem through redistribution through taxation or by revolution. The bailout of Cyprus is the beginning: the rich have to pay more than the poor. In Cyprus, there is a social element where they go after the rich. Even in America there are clear signs, like individual retirement accounts being limited to USD 3 million. The writing is on the wall.